Life Settlement

A life settlement is the legal sale of an existing life insurance policy for more than its cash surrender value to a third-party investor. The investor assumes the financial responsibility for ongoing premiums and receives the death benefit when the insured passes away.

So, how can this financial transaction benefit you? It could provide you with financial freedom.

When a senior receives their life settlement, they can spend it completely at their discretion — with no strings attached. It is common for seniors to utilize their payouts to cover medical bills, assisted living expenses, accumulated debt, or simply to supplement their retirement lifestyle. However, there are never any guidelines on how one can spend their settlement payouts. This lump sum of cash can alleviate many of your financial worries.

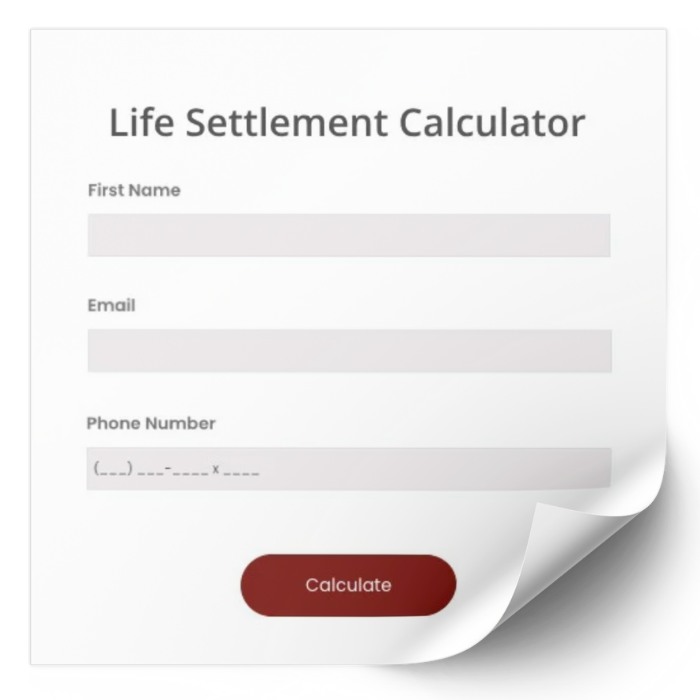

To see if you qualify for the life settlement solution, click the contact us below!

contact us